The Internal Revenue Service has begun a broader review process for some 2026 tax refunds, particularly those in the $1,000–$3,000 range. This extra screening is part of ongoing efforts to reduce errors, prevent fraud and ensure that refunds are issued accurately. While most taxpayers receive refunds within a standard timeframe, those whose returns trigger additional review may experience delays before their payment is released.

Why Some Refunds Are Being Reviewed

When the IRS detects certain patterns in a tax return, the system flags it for further verification. This can happen for a variety of reasons, including:

- Claiming certain refundable credits

- Errors or inconsistencies in reported income

- Unverified identity details

- Missing or mismatched forms

The review is intended to protect taxpayers and the broader system, but it can slow down the refund timeline.

Which Refunds Are Most Affected

Returns with expected refunds between $1,000 and $3,000 are more commonly pulled for review because they often involve typical filing situations such as:

- Earned Income Tax Credit (EITC) claims

- Child Tax Credit (CTC) adjustments

- Education-related tax benefits

These credits require extra validation to ensure eligibility, triggering additional checks in some cases.

Expected Timeline Changes

Under normal circumstances, electronically filed returns with direct deposit are processed within 7–21 days of IRS acceptance. However, if your return is selected for review, this timeline can extend to 4–8 weeks or longer depending on the complexity of the case and how quickly the IRS can verify information.

How to Check Your Refund Status

Taxpayers can track the progress of their refund using the official IRS tool Where’s My Refund? This online service shows the current status of your return and may indicate if additional review is underway. Status stages include:

Return Received

Refund Approved

Refund Sent

If the status remains unchanged for several days, it may indicate a longer review period.

Why This Review Process Matters

Although delays are inconvenient, the review process helps ensure that refunds are issued correctly and reduces the risk of identity theft and improper payments. The IRS uses algorithms and verification checks to make sure taxpayers receive the refunds they deserve — and only the refunds they qualify for.

What Taxpayers Should Do

If your refund is under review:

- Be patient and monitor the status online

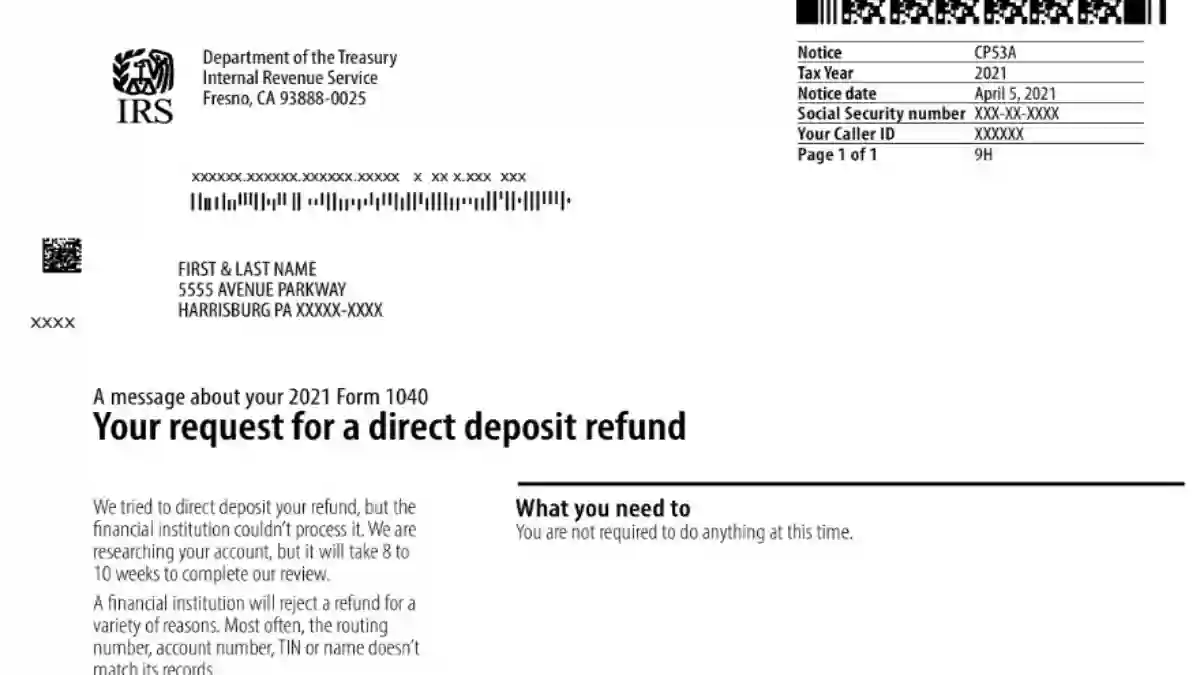

- Check your mail and IRS online account for requests for more information

- Respond promptly if the IRS asks for identity verification or additional documents

- Keep copies of your return and related documents handy

Prompt responses can help shorten the review period.

When You’ll Get Your Refund

Once any review is complete and your return is approved, the refund will be released. For direct deposit payees, money usually appears within a few business days of issuance. Paper checks take longer due to printing and mailing times.