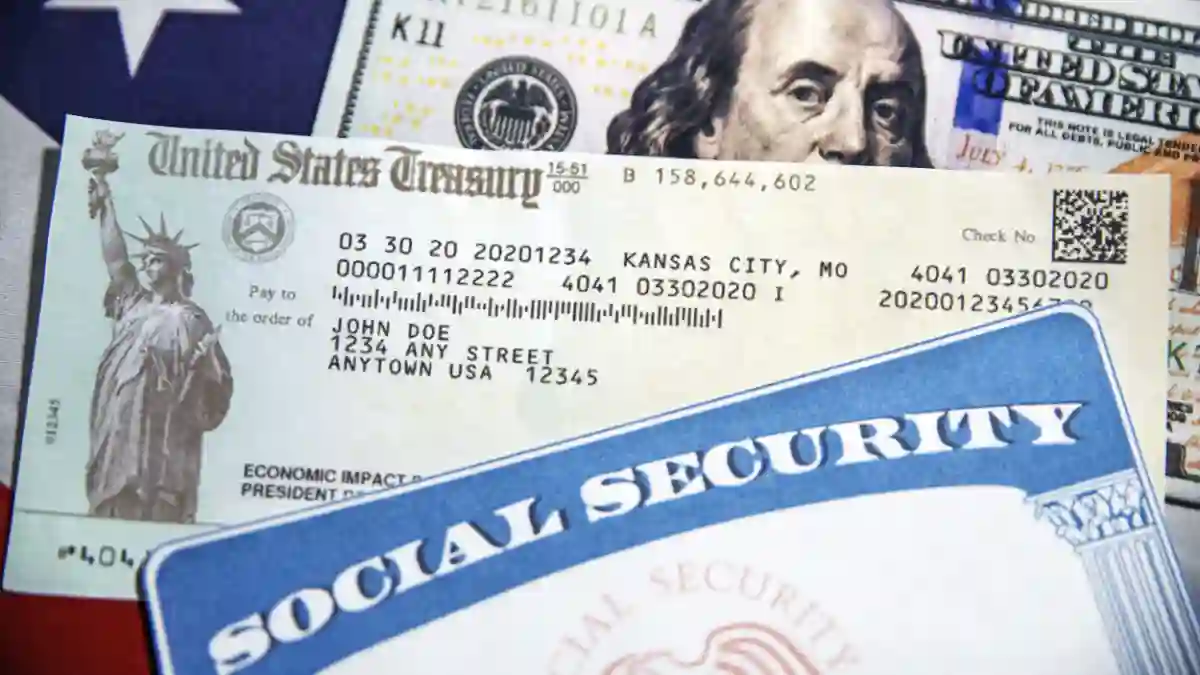

Millions of Americans who depend on monthly benefits could notice larger deposits arriving in February. Payment adjustments connected to cost-of-living protections, benefit recalculations and recent policy updates are now moving into the distribution phase. For retirees, survivors and people with disabilities, even small increases can make a meaningful difference in everyday budgeting.

The changes are being administered by the Social Security Administration, which manages payment delivery and determines final amounts based on each beneficiary’s earnings history and eligibility category.

Why Payments Are Going Up

Benefit levels are not fixed forever. They are reviewed and adjusted to help recipients maintain purchasing power as prices for essentials such as food, housing and healthcare change. When legislative updates and annual formulas align, beneficiaries may see higher payments at the start of a new cycle.

February is often when many people begin noticing the updated totals reflected in their bank accounts.

Who Is Likely to Benefit

The increase can apply across multiple groups, including:

Retired workers receiving monthly benefits

Individuals on disability programs

Survivor beneficiaries

Dual recipients who qualify under more than one category

Because payments are individualized, the amount of the boost will vary.

How Much More Money Could Arrive

There is no single universal raise. Some households might see modest additions, while others could receive more noticeable jumps depending on work history, retirement age and previous benefit levels. The calculation happens automatically, so most recipients do not need to take action.

When February Deposits Happen

Payments are generally distributed according to a schedule tied to birth dates or program type. That means funds arrive on different days throughout the month. Once released, direct deposits usually clear quickly, though exact posting times depend on banks.

How Beneficiaries Learn About Changes

Most recipients are informed through official notices or secure online messages. These summaries show the updated amount and may outline how the figure was determined. Reviewing them can help prevent confusion when deposits change.

Why This Increase Matters Now

Higher living costs continue to challenge many fixed-income households. A rise in benefits may help cover prescription expenses, grocery bills or utility payments. Financial planners often suggest using part of any increase to strengthen emergency savings where possible.

Practical Steps to Take

To stay prepared, beneficiaries may want to:

Confirm their direct deposit details are correct

Watch for official communications

Check bank activity on scheduled payment days

Update contact information if it has changed

Simple preparation can help ensure smooth delivery.

Final Thoughts

February’s higher payments reflect how policy decisions gradually flow down to everyday Americans. While increases will not be identical for everyone, they represent continued efforts to help beneficiaries manage rising expenses. Monitoring your account and staying informed will make it easier to understand what the change means for you.